This post originally appeared on Dow Jones’ blog The Conversational Corporation.

In the summer of 2011, Netflix was the future of video and its stock was at an all-time high. Within a quarter, the company lost two-thirds of its market value and its strategy was a shambles.

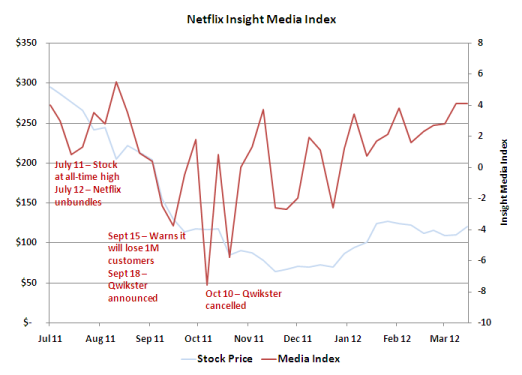

Between July and October 2011, the company unbundled its DVD and streaming services, increased its prices for the second time in a year, announced that it expected to lose a million customers and that it would spin off its DVD service under the brand “Qwikster”, and then canceled Qwikster less than a month later.

Netflix’s stock price has not recovered.

Netflix was trying to mitigate some powerful strategic threats in the summer of 2011, but the company lost control of its message.

I charted Netflix’s Dow Jones Insight Media Index (IMI) for 380,000 news stories since last July. Since October, Netflix’s IMI has returned to its summer 2011 levels, but the company’s stock price is stuck in the doldrums.

The Netflix debacle is more of a strategic than a communications fable, but there are some clear lessons for marketers:

• Think ahead. By delaying the inevitable unbundling until the last minute, Netflix maximized the pain for their customers and themselves.

• Keep it simple. Netflix was founded on a principle of simplicity, but Qwikster was just baffling.

• Own your name. Someone already owned @Qwikster on Twitter. This expensive error signaled a lack of preparation to the markets.

• Think twice before doubling down. Netflix followed its unpopular unbundling with a baffling spinoff.

Categories